find your perfect postgrad program

Search our Database of 30,000 Courses

MBA Loans

An MBA loan enables aspiring managers to pursue their goals and study for an MBA degree (Master of Business Administration). An MBA is regarded as a highly prestigious degree and is a significant investment in your future.

MBA degrees are generally considered eligible for the same funding options as any other masters-level degrees in the UK. This is good news for students that require funding. It means that MBA students can access the same Government funding opportunities as masters students.

Who needs an MBA loan?

MBA job candidates are highly sought after by employers. This makes MBA programs extremely competitive. Due to the high demand and expertise of academic tutors, MBA tuition fees are often higher than those of other masters courses, making access to MBA loans even more essential for students.

In fact, MBA students may need more than one source of funding to make it through their course without feeling worried about their budget. So, let's take a look at some of the MBA loans and funding options available to students in the UK.

Find your PERFECT BUSINESS PROGRAMGovernment masters/MBA loans in England

How much can I borrow?

For courses starting in 2022/23, postgraduate students will receive a loan of £11,836 towards tuition fees. You can choose how much you want to borrow, up to the maximum amount. The loan is not means-tested, therefore the amount you receive does not depend on your financial situation.

Does the value of the MBA loan depend on course fees?

The amount you will receive for your MBA loan is not linked to the cost of your course. The total available you can borrow is £11,836 regardless of how much your tuition fees are. Therefore, your course fees could be more than the value of your MBA loan and you will also need to consider additional living costs and other expenses.

Which students are eligible?

MBA loans in England are only available to students who do not already have a masters degree or higher qualification.

Students must be UK citizens or have lived in the UK for at least three years. Students who have either settled in the UK, have pre-settled status or have the permanent right to remain are also eligible. Only students who are under the age of 60 when their course starts can access government funding in England.

How should you apply?

In England, students should apply online at GOV.UK – Masters Loan or complete a paper application from Student Finance England.

What are the application deadlines?

Students must apply within nine months of the first day of their course. Ideally, you should apply as soon as you know you have a confirmed place on the MBA program before any tuition fee payments are due.

What about the repayments?

Depending on how much you earn after you graduate you will begin repaying your loan in the April upon completion of your MBA. Most MBA graduates will start paying their loan back at this time, but the threshold is currently around £21,000. This varies depending on when you took your loan out. Payments are calculated and made through the PAYE tax system or during the self-assessment tax process before any other deductions are made.

Government masters/MBA loans in Scotland

How much can I borrow?

The Student Awards Agency Scotland (SAAS) provides financial support for Scottish MBA students, including those undertaking an online MBA program. This support is also offered to students studying at universities in England as long as the course isn’t offered at a Scottish university.

Scottish MBA loans are split into two parts; a tuition fee loan that is worth up to £5,500 and a separate loan for living costs of up to £4,500. The postgraduate living cost loan is split equally across the duration of the course, so a student on a full-time one-year course will receive £4,500 for the year, while those on a full-time two-year course will receive £2,250 per year. These loans are not means-tested so your financial situation is not relevant to the amount you will be awarded.

Students must be under 61 years old on the relevant loans application dates to be eligible for the full MBA loans in Scotland.

Does the value of the MBA loan depend on course fees?

Just like in England, the amount you can borrow is not related to the tuition fees. The total amount available for full-time MBA students in Scotland is £10,000.

Which students are eligible?

In Scotland Government MBA loans are only available to students without a masters degree in another subject area. You must be a Scottish resident before the start of your MBA course and have lived in the UK, Channel Islands or Isle of Man for three years if you are from the EU. Students who have settled status through the EU Settlement Scheme (EUSS) are also eligible.

Part-time students also qualify for the tuition fee loan of £5,500, as do students who are over 60 years old at the start of the course. However, part-time students or students who are over 60 do not qualify for the maintenance loan of £4,500.

Who should you apply to?

Students apply to the Student Awards Agency Scotland (SAAS) and if you have applied in recent years, for example for an undergraduate loan, you will use your existing log in. Students who are studying after a significant break from their studies will have to create a new account.

What are the application deadlines

Any funding application must be made by the 31st March of that academic year. If you are starting your MBA in September of 2023, for example, then you must apply by the 31st March 2024. It is a good idea to get your application in as early as possible to ensure you receive your funding before the start of the course, and applications for student loans usually open in the June before the September start date.

What about the repayments?

You'll start making repayments from April after you graduate or finish your course. The SLC will contact you before you start making payments to explain how this will work.

If you find employment after you graduate, you will start paying your loan back when you earn more than a certain amount, known as a 'salary threshold' – the salary threshold is currently £25,375.

If your salary is higher than the threshold and you aren't paying student loan payments, you should speak to your employer. If your salary drops below the salary threshold your payments will be stopped and will start again once it goes back above the salary threshold.

Repayments are made at 9% of any income over the threshold of £25,000 and this is paid through the tax system, as it is in England.

If you also have a Scottish undergraduate loan, this will be combined with the postgraduate loan into one payment of 9% a month.

If you earn over the threshold and are employed, repayments will be taken automatically from your salary. If you're self-employed, your repayments will be part of your self-assessment tax return.

You will be charged interest from the date you make your first instalment to your university. The rate of interest is linked to the retail price index (RPI) or the Bank of England base rate plus 1%, whichever is lower.

Government masters/MBA loans in Wales

Government masters/MBA loans in Wales

How much can I borrow?

MBA students in Wales can get up to £18,430 of funding in 2022/23 to contribute towards tuition fees and living costs. This is a mixture of a loan and a grant, and the amount you get depends on the household income.

Does the value of the MBA loan depend on course fees?

Just like England and Scotland, the amount you receive is not linked to the cost of the course. Unlike England and Scotland however, in Wales there is a means-tested grant that is available to students whose household income falls below a certain level. For students whose household income is below £18,370 then they can access a grant of up to £6,885 and a loan of up to £11,545.

For those who have a household income above £59,200 or do not wish to be assessed then the grant is £1,000 and the loan is up to £17,430. Student households that fall between these two income limits will be able to apply for a grant or loan somewhere in between. Household income includes your parents’ income if you live with them, or any partner’s income.

This table, from Student Finance Wales, illustrates examples of the breakdown of the loan and grant depending on the applicant’s salary.

|

Household income |

Loan |

Grant |

|

£18,370 |

£11,545 |

£6,995 |

|

£25,000 |

£12,500 |

£5,930 |

|

£35,000 |

£13,942 |

£4,488 |

|

£45,000 |

£15,383 |

£3,047 |

|

£59,200 |

£17,430 |

£1,000 |

Which students are eligible?

The eligibility requirements for MBA loans are the same as in England, so you must not have a masters-level qualification and need to be under 60 years old on the first day of your course. You must also be normally resident in Wales studying a course in a UK-based university. If you are not a UK national then you must have lived in the UK, Channel Islands or the Isle of Man for the past three years.

Who should you apply to?

To apply for an MBA loan in Wales you should apply to Student Finance Wales online. Contact them directly if you have difficulty applying online for alternative arrangements.

What are the application deadlines?

Applicants should apply in plenty of time for the MBA loan, as students who apply late may only receive the minimum loan and grants available. The deadline in Wales is nine months after the start of your MBA course and you are advised to apply as early as possible.

What about the repayments?

The debt is cancelled if you are disabled or ill and rendered unable to work. Otherwise, repayment terms are the same as England. The loan is paid at 6% of any income earned over £21,000, and repayments usually start on the April after graduation for most MBA students.

Government masters/MBA loans in Northern Ireland

Government masters/MBA loans in Northern Ireland

How much can I borrow?

MBA students in Northern Ireland can access postgraduate loans of up to £5,500 in 2022/23 to cover their tuition fees.

This amount is not means tested and all students are entitled to apply for it.

Does the value of the MBA loan depend on course fees?

Just like England, Scotland and Wales, the loan amount available in Northern Ireland is not linked to the course fees. The total amount available is £5,500 and this is for tuition fees only.

It is paid directly to the university in three lump sums during the academic year, normally around the start of each term. The first two payments are both 25% of the total amount borrowed, the final payment is the remaining 50%.

Which students are eligible?

If you are over 60 when you start your course, you can still apply for the loan, but you must normally reside in Northern Ireland or the Republic of Ireland. Students can be studying their MBA program either part time or full time, but they must not already have a masters-level qualification.

Who should you apply to?

You can apply for an MBA loan in Northern Ireland online by logging into your Student Finance NI – Login where you will find the relevant forms to complete.

What are the application deadlines?

You should apply as early as you can. Student Finance Northern Ireland publicises when their loan applications open on their website, and you should apply within nine months of your course starting.

What about the repayments?

The repayments are similar to the repayments in Scotland, which begin when the applicant earns over £20,195. Students pay 9% of any income earned over this threshold through the tax systems in the same way as students in England, Scotland and Wales do.

Can you combine a Government loan with other loans?

It is possible to combine your Government loan with other loans and doing so may help you to cover the cost of your MBA program. Although bursaries and scholarships from another Governmental department, such as an NHS Bursary may be excluded. If you have a Government loan you can borrow more money from private or commercial financial institutions to top up your funding.

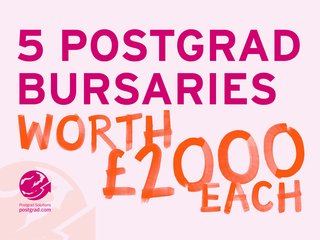

Apply for one of our x5 bursaries worth £2,000

We've launched our new Postgrad Solutions Study Bursaries for 2024. Full-time, part-time, online and blended-learning students eligible. 2024 & 2025 January start dates students welcome. Study postgraduate courses in any subject taught anywhere worldwide.

MBA-specific private loans

Some private student loan providers offer loans that are tailored to the needs of MBA students. Some good examples of this are Lendwise and Prodigy Finance. These private loan companies are focused on students, which means they have specially designed terms and conditions, such as very low or even no repayments until after graduation.

Lendwise will work with most MBA students and do not require a loan guarantor, although they will require a credit check. There are some private student loan providers that work all over the world, such as Prodigy Finance, and this is a great option for international MBA students who may want to study or work in more than one country.

Their funding options are linked to over 700 institutions around the world, so check their website to see if they work with a business school that interests you.

MBA loans from Prodigy Finance

Here are the details of Prodigy Finance loans available to MBA students from 150 different countries.

Here are the details of Prodigy Finance loans available to MBA students from 150 different countries.

|

Amount |

£10,000 to £22,000 |

|

Eligibility |

Potentially available to international students from 150 countries; UK students studying in the UK; and US students from certain states studying in the USA. To be eligible for a Prodigy Loan students need to be studying at selected universities |

|

Considerations |

Credit score, salary and savings. Note – loans are only available for approved subjects and grades |

|

Repayment terms |

Full-time students begin repayments 6 months after graduation; part-time students begin repayments 3 months after receiving their first loan payment |

MBA loans from Lendwise

Here are the terms and details for Lendwise loans for MBA students worth up to £100,000.

|

Amount |

£5,000 to £100,000 |

|

Eligibility |

Potentially available to students of all nationalities living in the UK and studying at a UK university |

|

Considerations |

Credit history, credit score, work experience, current salary and academic qualifications |

|

Repayment terms |

Repayments start 6 months after graduation |

Commercial bank loans for MBA students

Many traditional financial institutions will offer personal loans to MBA students. These are most likely to be offered to those with a good credit rating and who are studying on a part-time basis, and thus working whilst studying for their MBA. A student's ability to make repayments makes them more attractive to banks. Unlike student loan providers, commercial bank loan repayments are likely to begin immediately after the loan has been issued.

Employer sponsorship for MBA students

MBA qualifications are highly valued by many employers, and those students who are already employed in a relevant field may find that their employer is keen to help fund their MBA studies. If this is the case, you should carefully consider what your employer is offering before agreeing.

Some employers will offer an MBA loan that you pay back to them directly out of your salary. Others may offer to pay at least part of your MBA tuition fees. They may require you to sign terms that say you will continue to work with them for a certain number of years after your MBA. If you break the terms of your MBA loan agreement, then you may have to pay back the tuition fees to your employer.

Find your PERFECT BUSINESS PROGRAMHere we have compiled answers to frequently asked questions about UK MBA loans. If you still have any unanswered questions about MBA loans please email us and we will do our best to help.

Do MBA courses qualify for a UK Government masters loan?

Yes – MBA courses do qualify for UK Government masters loans as long as the student meets all the eligibility requirements and hasn’t previously taken out a masters loan.

Are UK Government MBA loans means-tested?

No – all that matters is that you and your MBA course are eligible for the loan, your income and savings do not affect your eligibility.

Can I apply for a UK Government masters loan if I’ve lived outside the UK in the last three years?

No – to apply for a loan as a UK student you must have lived in the UK for three years prior to your MBA course. You can have travelled from the UK for holidays or periods of temporary absence during these three years, but you shouldn’t have become ordinarily resident in another country.

Will my credit history be checked?

Your personal credit rating and existing debts won’t matter for UK Government masters loans unless you are in arrears with the Student Loans Company. Your credit history will usually be checked with private funding companies like Prodigy Finance and Lendwise.

Can I get an MBA loan whilst working?

Yes – you can have a job during your MBA studies and still access UK Government masters student finance. You will also be able to apply for a private loan from companies like Prodigy Finance and Lendwise if you are studying your MBA whilst working.

Can I apply for a second UK Government MBA loan?

No – you can’t apply for a second MBA loan if you have already had one for a previous masters course.

Can I get a UK Government masters/MBA loan if I already have a masters degree?

No – UK Government masters loans are only available to people who do not have existing masters-level qualifications (or higher).

Can I apply for a UK Government masters/MBA loan if I already have a Postgraduate Certificate or Postgraduate Diploma?

Yes – you can apply for a loan for an MBA degree if you already have a PG qualification below masters level, such as a PGCert or PGDip.

Can I apply for a UK Government masters/MBA loan if I already have a PGCE?

Yes – you can still apply for an MBA loan if you already have a PGCE.

Can I get a UK Government masters/MBA loan if I already have a PhD?

No – you can’t apply for a UK Government loan for your MBA if you already hold a PhD (or other doctorate), they are only available if you don’t already have existing qualifications at masters level or higher.

Will I still receive Disabled Students’ Allowance if I have a masters/MBA loan?

Yes – payments and eligibility for Disabled Students’ Allowance (DSA) are separate from postgraduate loans.

When will I have to start making my MBA loan repayments?

Your loan repayments will depend on what home nation or private company you get your loan from. In most cases – unless you get an MBA loan from a bank – MBA loan repayments will start after you graduate from your MBA program.

Disclaimer: Prodigy Finance and Lendwise are two of many potential funding options for postgraduate students. Other student funding options are available; research all your options thoroughly before making a commitment. Please be aware that Postgrad Solutions Ltd receives a commission from both parties for any successful loan applications taken out by Postgrad.com and LLMstudy.com users. Postgrad Solutions accepts no responsibility for your choice of loan and does not endorse or support Prodigy Finance or Lendwise. Prodigy Finance Ltd is authorised and regulated by the Financial Conduct Authority, and entered on the Financial Services Register under firm registration number 612713. Lendwise Ltd is authorised and regulated by the Financial Conduct Authority under firm registration number 782496.

Find your PERFECT POSTGRAD PROGRAM